There are several solutions to this situation: First: you may get French VAT registration. France is the only country in the EU that supports deferred VAT – you don’t need to pay at import. And when you buy from an Italian supplier they will invoice you without VAT (reverse charge). Second: You use an EU company (or Branch of a US company registered in the EU). Then Amazon or other marketplaces will not remit VAT. And you will be able to pay VAT for the difference in your VAT return. Third: use other marketplaces. Zalando, Cdiscount, and several other marketplaces don’t remit VAT from non-EU suppliers.

VAT software that’s easy and affordable

Running VAT for your online business is one of the most important aspects of any successful cross-border sales, but that doesn’t mean it has to be stressful. With first-class VAT software, you’ll experience peace of mind knowing you have the resources to calculate your taxes across several jurisdictions and do reporting on time.

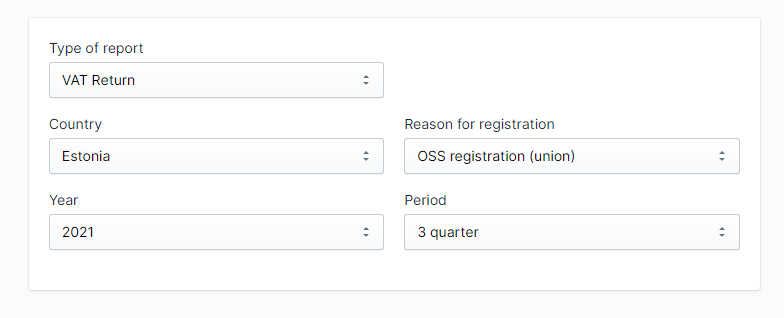

Timely VAT reporting with LOVAT

How it works

Automating VAT calculation

Tracking your thresholds

Securing your VAT data

Lovat’s VAT software features

- Simplified tax data uploading

- Custom tax settings components for each sale channel

- Single click auto-submission of VAT returns to all countries

- Online VAT payments and payments memos

- Pre-formatted tax reports: JPK, Intrastat, Sales list, and others

- Threshold tracking

- All communication with TA scanned and stored in one place

Compliance Peace of Mind: the software can train users on VAT compliance topics and assess them regularly. It also aggregates news and industry trends into a feed to keep users updated on VAT laws.

Customer Testimonals

Frequently asked questions

We are a US company and sell to European customers. We pay VAT twice: first time at import and another one when a marketplace remit EU VAT as a facilitator. We registered in Italy, and it takes a lot of time to get a refund. What can we do to avoid double taxation?

If a Swedish VOEC registered customer exports to Norway, does Norway VAT have to be included?

It’s important to note that the VOEC scheme only applies to sales to consumers (B2C), not to businesses (B2B). The VOEC scheme applies only to goods with a value of NOK 3,000 or less (excluding shipping and insurance), which are sent from a foreign business to a consumer in Norway. The lowest value for each item cannot exceed 3000 NOK.

Do I need a VAT number in Belgium as an Amazon seller based in the UAE with sales in Belgium but no stock in Belgian warehouses?

As you said your company is non-EU. You don't need to register in Belgium as soon as it is Amazon responsible for tax payment.