It is a special term for tax purposes. It means that your company is connected to the specific US state in spite company having neither office nor goods stored in this state. Economic nexus may occur when a company sells over the year threshold to this specific state. If a company has an economic nexus it needs to register for sales tax in the state. See the video how to fill in the information in your Lovat account and upload your sales data in order to track your economic nexus thresholds for the US.

Automate Sales Tax: easy to use and seriously smart

Watch a short video that will tell you about the main functions of the Lovat platform

Automating Sales Tax calculation

Track your Sales Tax thresholds

Securing your Sales Tax data

Lovat’s sales tax software features:

- Real-time sales tax calculation

- Auto-filing capabilities

- Pre-built integrations with main e-commerce platforms

- Custom tax settings components

- Threshold tracking

- The to-do list on the main page will not let you forget about due dates

- All data is stored on a secure server and cannot fall into the hands of intruders. Only you have access to the service

Track your sales tax thresholds for free: US sales tax thresholds differ from state to state and depend on what you sell goods or services. If you just started to sell remotely you may use our software to be able to understand where you need to get sales tax registration.

Meet our customers

Frequently asked questions

What is economic nexus?

Do I need to register for sales tax in Texas if I use a warehouse in Texas?

Yes, if you use a warehouse in a state, you automatically have Nexus and are obliged to get a sales tax registration. That means that you need to calculate sales tax in Texas as soon as you started to use a warehouse.

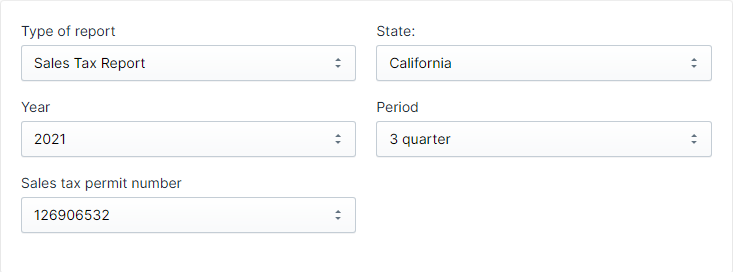

Can Lovat software check errors?

When reporting to Lovat, you can be sure that the report will not be lost and will be delivered on time. The built-in verification system will track possible errors already when filling out - you will be able to submit a correct report, which will be accepted from the first time. Technical support will answer any question quickly and competently at any time.

I’m a business established in Delaware and I sell online to customers from New York how can I calculate sale tax?

If you make several sales, you probably don’t need to calculate any sales tax because the economic Nexus in New York is $500,000 and 100 or more individual sales. When you will reach this threshold and get a sales tax permit you need to calculate a sales tax.

Can you do filing on behalf of the client?

Yes, you can register as a tax agent here and act on behalf of your clients, especially order sales tax registration online and file sales tax returns

How long will it take to setup/configure a new client so that we can file on their behalf?

To set up a new client in Lovat tax agent account can take up to 1 business day. After checking information and your certificate, you will sign the power of attorney and then it will be possible to file sales tax returns on behalf of your client.

How long will it take to set up an auto file in the platform?

You can add this option in the Tax settings section in one click. For this action, you need to sign in your tax agent account.

Can show filing status per return?

Yes. You can check the status of your return in the Sales tax returns section and on the Dashboard as well. It can be Draft, Pending, Declined, Submited, New. When your return has the status “submitted”, you receive the e-mail with the notification about it.

My business is registered in Germany, I received a notification from my tax provider that they are stopping working with Amazon. How can I switch to another provider?

Looking to switch tax service providers? Ensure a comfortable transition by starting early. Details in our new article https://backup.vatcompliance.co/5-things-to-know-for-a-transit-from-one-tax-service-to-another/