Lovat Newsletter – May 2024

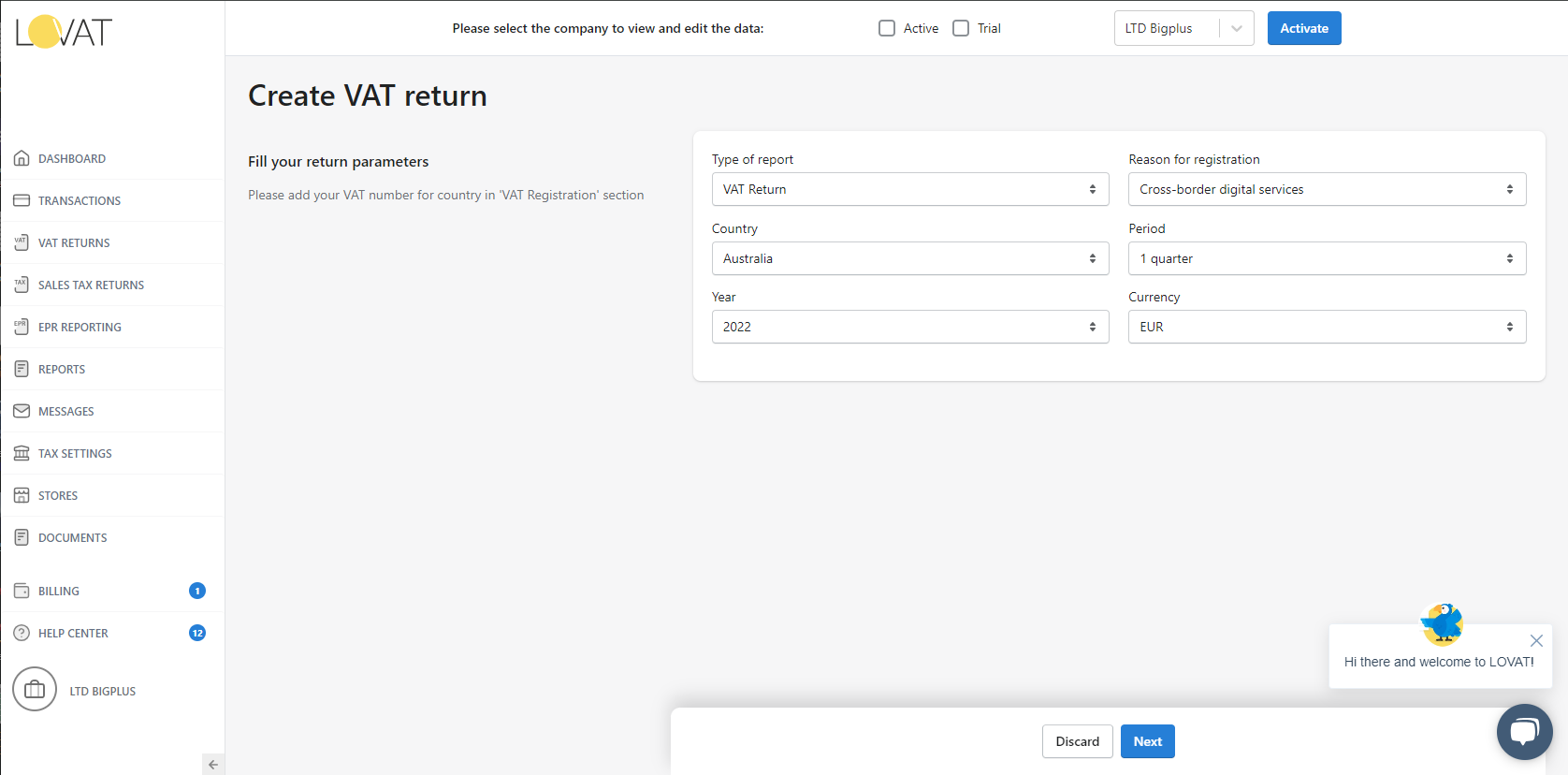

Currency choice for tax return

Now you can effortlessly select the convenient currency for your tax returns on the Lovat platform. This eliminates the need for manual conversions, saves time, and minimizes errors.

Benefits of currency choice:

- When you receive payments in USD and you need to pay taxes in several countries you may fill out your revenue in dollars even when your tax return will be submitted in Canadian dollars or Norwegian Krones. A proper currency exchange rate is applied automatically.

- Reduce the risk of errors using different currency exchange rates for different types of transactions.

- Global reach: Sell anywhere: Lovat supports 126 currencies.

The new multi-currency feature is now available to all distance digital sales.

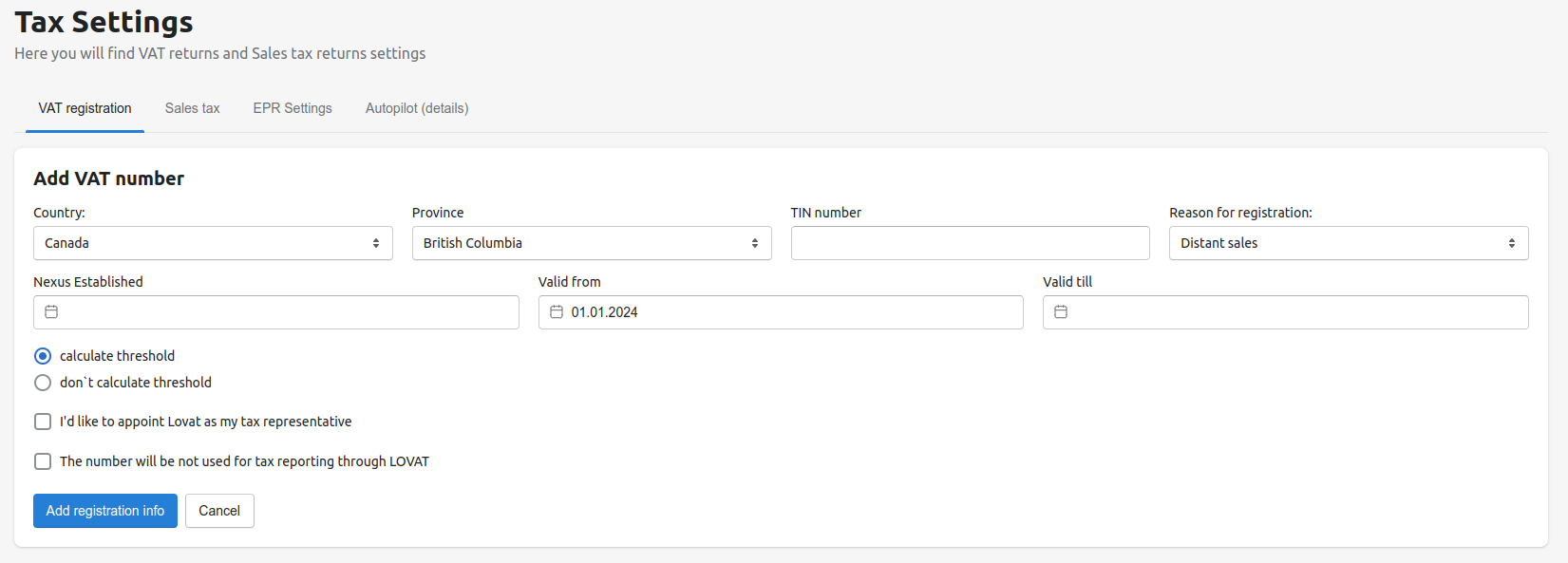

Canadian PST returns updated

When businesses sell to Canadian customers they need to register for GST – registration threshold for GST is 30.000 CAN. Provincial limits have also been set for Provincial Sales tax (PST) registrations. And as soon as a company exceeds this sales limit in the province, it needs to register for PST. Lovat has made filing Provincial Sales Tax (PST) returns in Canada even easier. We updated the PST return with a new province selection feature in the tax settings section. This allows you to specify quickly and accurately the province for your sales and ensure your returns are compliant with local regulations.

#2 for Ease of Use on G2

Lovat has reached a significant milestone and has risen to 2nd place in the G2 “Easiest to Use” category for VAT and sales tax compliance software!

This recognition from G2, a leading business software review platform, is a testament to our continued commitment to providing a user-friendly and intuitive platform.

Slovakia EPR guide

If you have sales in Slovakia please check your types of goods. In this article, we covered what type of businesses need to be registered in Slovakia fo EPR.

EPR for non-packaging in Slovakia

France- Toys EPR guide

Toys include a wide variety of products, and many countries have introduced additional EPR registration for toys. In order to understand what types of goods fall under this type of reporting in France, read the article EPR for toys in France.