Lovat Newsletter – February 2024

Software update

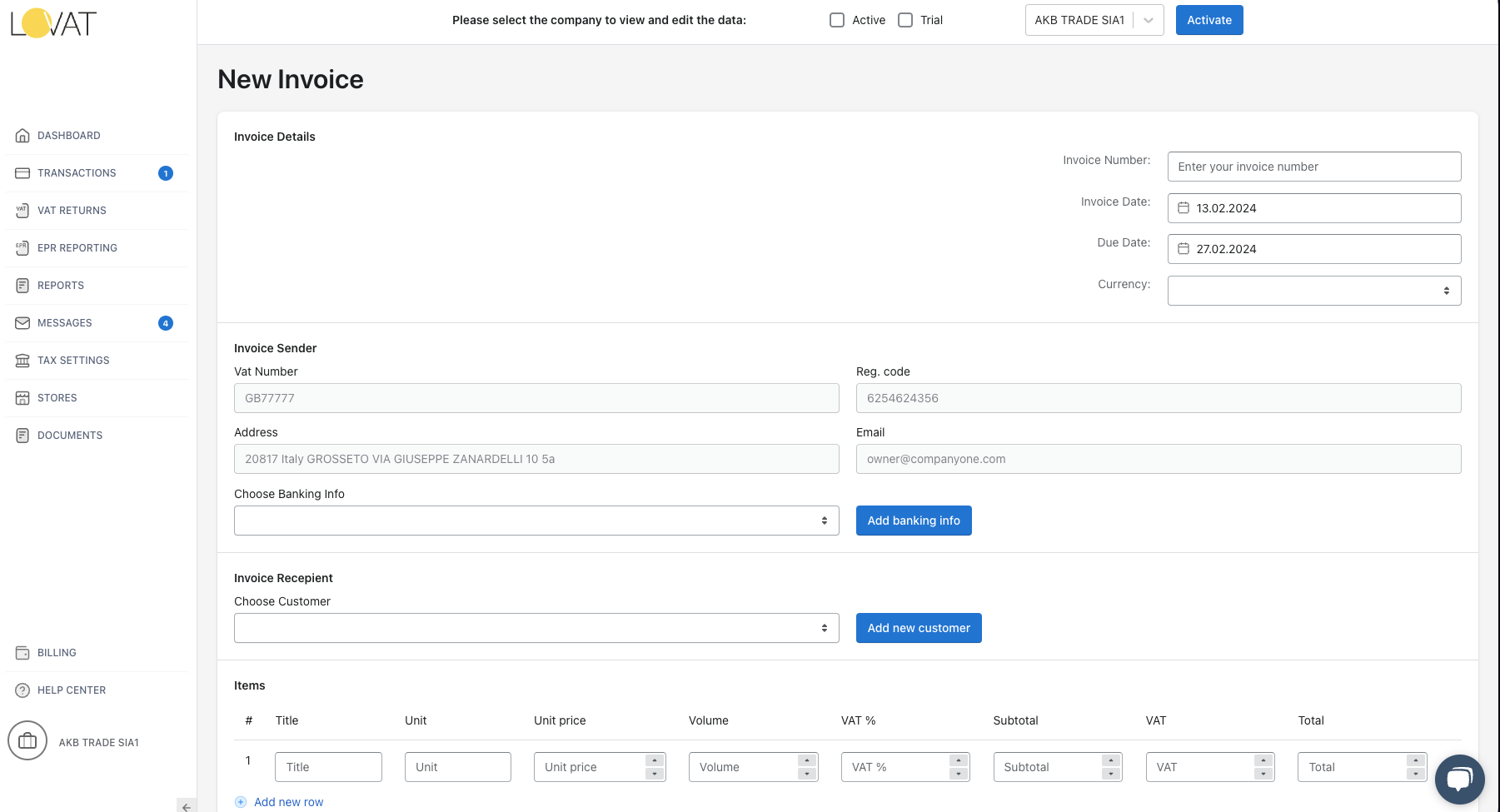

The invoice feature is now available

We are excited to announce that we have added a new function to our Lovat software: invoice generation. This means that you can now easily create and send invoices to your clients, with the correct tax rates and calculations applied.

Deadlines

US marketplaces reporting obligations for form 1120

March 15, 2024 – if the corporation has premises in the US);

April 15, 2024 – if the corporation doesn’t has premises.

If you require Lovat assistance with the form submission please feel free to reach out so we can provide you with the quote and information needed for submission info@backup.vatcompliance.co Find out how Lovat can help you with your EIN and sales tax needs.

DAC7 reporting deadlines postponed

Some countries have announced extensions for the first reporting deadline, which was originally set for 31 January 2024.

April 1 – Germany.

February 19 – Luxembourg.

DAC7 Return Filing with Lovat https://youtu.be/sPX6B1o5AoM

Marketplaces

Form 1099-K: Marketplace reporting obligations – USA

Are you a marketplace that facilitates sales of goods or services in the US? Understand Form 1099-K reporting for your online platform, payment app, or payment processor. Learn more

Who must register and report for DAC7 in the UK?

Understand who needs to register, deadlines, and excluded categories for online platforms facilitating sales in the UK under DAC7 regulations. Read more

We are here to support your compliance journey. If you have questions or need assistance, feel free to reach out to our dedicated team. Contact us

Follow us on social networks to be the first to know the latest news: Facebook, LinkedIn