Lovat Newsletter – April 2024

For merchants

New EPR rules in US

14 US states considered draft EPR laws in the past year. Most will create producer responsibility programs and some, like New York, are expected to finalize legislation in 2024 for a 2025 rollout. These laws aim to increase packaging recycling from 25% to 70% by 2050.

10 types of chemical products for EPR reporting

Companies exceeding a 100kg annual threshold (except fire extinguishers) must register with ADEME, the French environmental agency. A unique ID and annual fees are required for compliance.

For marketplaces

New Tax Reporting Rules for Online Platforms in Australia

Starting July 1st, 2024, online marketplaces operating in Australia, both domestic and foreign, must provide seller details and payment information to the Australian Taxation Office (ATO). There’s no minimum transaction amount, so even small sales get reported.

New Zealand’s Income reporting rules

Starting on January 1, 2024, operators of online marketplaces based in New Zealand are required to gather and submit data regarding sellers who offer services outlined by the Organisation for Economic Co-operation and Development (OECD) via their platforms.

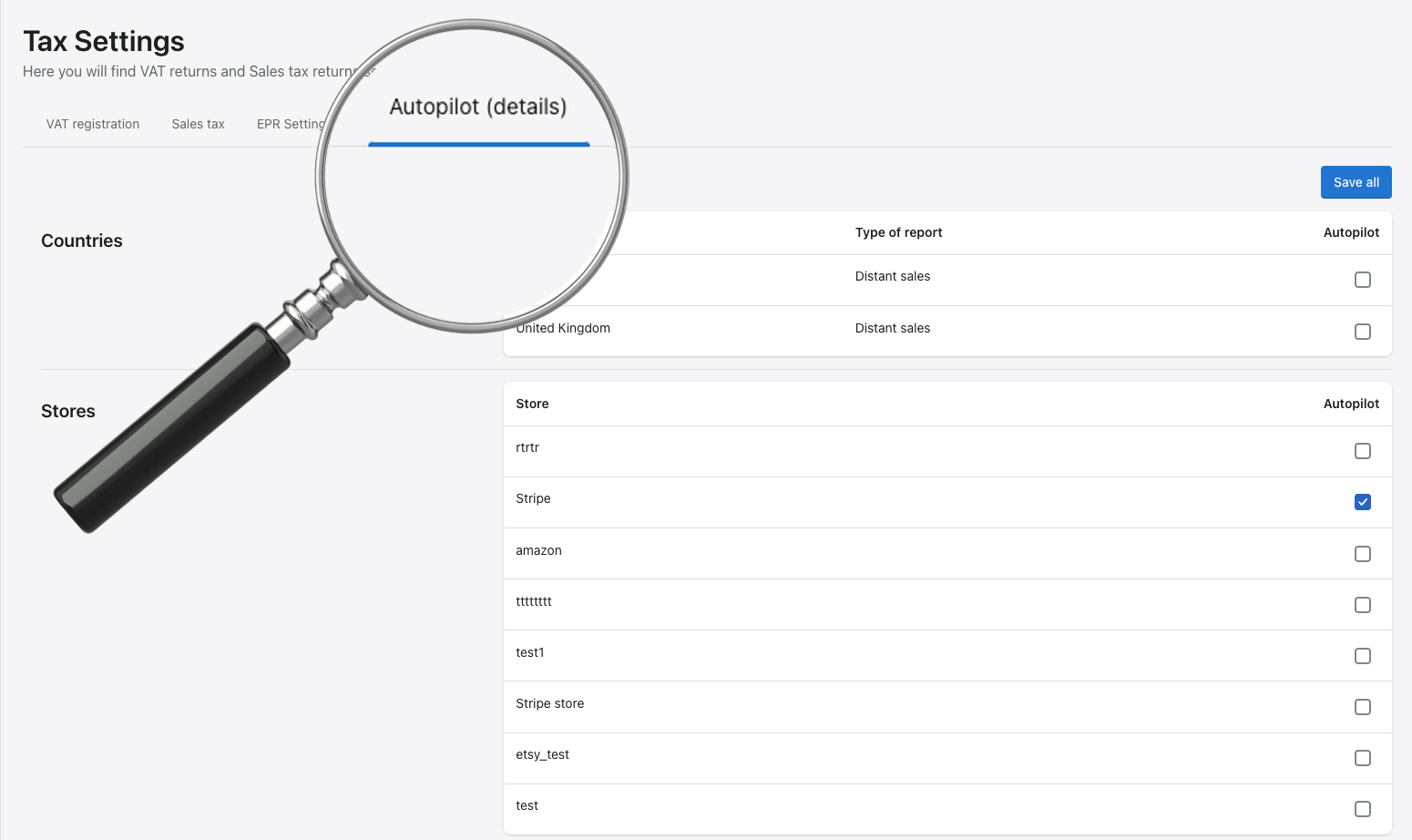

Autopilot VS Autosubmit

The difference between autopilot and auto-submit: Learn which service helps you file and which one simply submits your completed return.

How to fill out 1099-K online?

Our new video makes it EASY! Learn how Lovat simplifies reporting & guides you step-by-step.

Lovat software update

Lovat updated OpenCart Integration for E-commerce transactions. This update streamlines the connection between Lovat and OpenCart, simplifying the process for online merchants to manage transactions and enhance their customers’ shopping experience. Uploading guide here

We are here to support your compliance journey. If you have questions or need assistance, feel free to reach out to our dedicated team. Contact us

Follow us on social networks to be the first to know the latest news: Facebook, LinkedIn